BTC Price Prediction: Analyzing the Path to $200,000 Amid Current Market Conditions

#BTC

- Technical Consolidation: Current price action suggests Bitcoin is in a consolidation phase below key moving averages, requiring breakthrough above $114,000 for bullish confirmation

- Market Sentiment Shift: Recent liquidations have reset leveraged positions, potentially creating healthier market conditions for future growth

- Regulatory Balance: Mixed regulatory developments globally create both challenges and opportunities for Bitcoin's adoption trajectory

BTC Price Prediction

BTC Technical Analysis: Current Market Position and Key Indicators

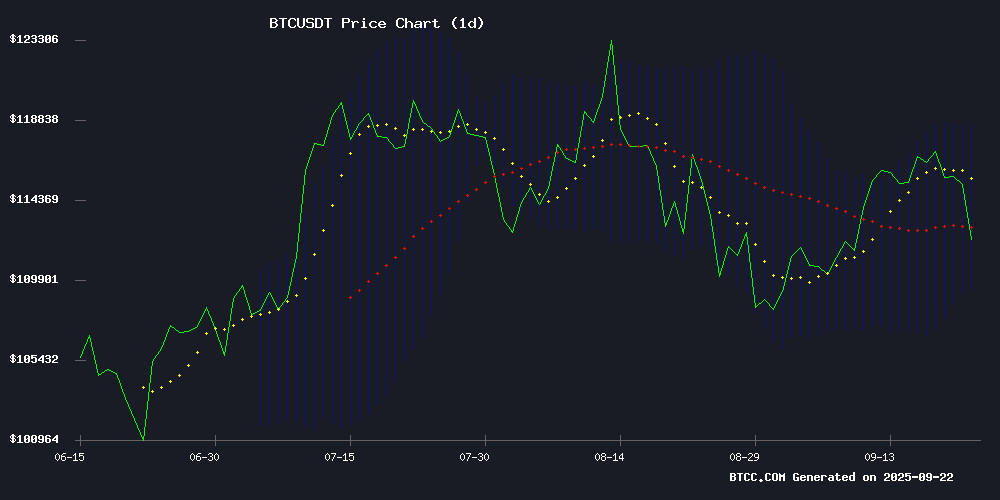

According to BTCC financial analyst Mia, Bitcoin is currently trading at $112,690.01, slightly below the 20-day moving average of $113,979.60. The MACD indicator shows a bearish momentum with values at -3100.96 (MACD line) and -2417.63 (signal line), resulting in a negative histogram of -683.32. The Bollinger Bands position Bitcoin between the upper band at $118,561.57 and lower band at $109,397.63, with the current price sitting closer to the middle band, suggesting potential consolidation.

Mia notes that the technical setup indicates short-term bearish pressure but with strong support levels nearby. The proximity to the lower Bollinger Band could signal a potential bounce if support holds.

Market Sentiment Analysis: Mixed Signals Amid Regulatory and Adoption Developments

BTCC financial analyst Mia observes that current news sentiment presents a complex picture for Bitcoin. Positive developments include growing adoption channels highlighted by 'Beyond Binance: A Faster, More Private Path to bitcoin Acquisition' and increased appeal in Vietnam due to banking restrictions. However, significant headwinds exist with the UAE's proposed 2027 crypto tax rules and Sygnia's caution against overexposure to Bitcoin ETFs.

Mia emphasizes that the $277 million liquidation wave and market reset, while painful in the short term, could create healthier foundations for future growth. The 'pre-euphoria signal' mentioned in one article aligns with technical analysis suggesting potential accumulation opportunities.

Factors Influencing BTC's Price

Beyond Binance: A Faster, More Private Path to Bitcoin Acquisition

Cryptocurrency newcomers face significant hurdles when attempting to purchase Bitcoin through traditional exchanges. Lengthy KYC verification processes, often spanning weeks, create unnecessary barriers to entry. Complex trading interfaces designed for professional traders further alienate retail investors seeking simple exposure to digital assets.

Geographical restrictions, slow bank transfers, and excessive credit card markups compound these challenges. The current ecosystem demands technical sophistication that many potential buyers lack, effectively gatekeeping bitcoin ownership behind needless complexity.

ChangeHero emerges as a potential solution, positioning itself as a streamlined alternative to conventional exchanges. The platform emphasizes speed and simplicity, contrasting sharply with the mortgage-like application processes of established players. Its instant exchange model draws parallels to airport currency kiosks—designed for quick, straightforward transactions rather than complex financial operations.

Vietnam Bank Account Purge Boosts Bitcoin Appeal

Vietnamese commercial banks have purged over 86 million accounts under new biometric regulations, leaving approximately 113 million active. The State Bank of Vietnam's crackdown targets unverified accounts to combat fraud and money laundering, but has inadvertently fueled interest in Bitcoin as a decentralized alternative.

Foreign residents face heightened challenges, with mandatory in-person identity checks creating barriers for those abroad. The MOVE echoes global trends of sudden account freezes, reminiscent of China's 2022 rural banking crisis where depositors were locked out for months during fraud probes.

As traditional banking systems demonstrate vulnerability to regulatory shocks, Bitcoin's censorship-resistant properties are gaining renewed attention. The cryptocurrency's ability to operate outside institutional control positions it as a hedge against financial exclusion.

Bitcoin Price Dips Below $113K as Liquidations Surge

Bitcoin's price slipped below $113,000 during European trading hours, failing to hold the $116,000 support level from the previous week. The correction triggered a cascade of liquidations, wiping out $1.7 billion in crypto positions—95% of which were long contracts. OKX saw the largest single liquidation: a $12.74 million BTC-USDT-SWAP position.

Japanese investment firm Metaplanet capitalized on the dip, adding 5,419 BTC to its treasury. Its holdings now total 25,555 BTC—a bold countermove against prevailing market fear. The Crypto Fear & Greed Index dropped to 45, reflecting trader caution after the sell-off.

Bitcoin Mining in 2025–2026: Beyond the ASIC Arms Race

The Bitcoin mining industry is undergoing a seismic shift as it enters 2025. Once a niche sector, Bitcoin has now cemented its place as a U.S. national reserve asset, with ETF holdings surpassing $100 billion. Institutional portfolios increasingly rely on it as a cornerstone investment. Yet the path hasn’t been smooth—tariffs have driven up equipment costs, the 2024 halving squeezed rewards, and record-high network hashrates have intensified competition.

Three transformative trends are reshaping mining’s future. ASIC performance is plateauing, ending the era of easy gains from hardware upgrades. The AI boom is monopolizing power and data centers, forcing miners to adapt or compete for resources. Meanwhile, institutional investors are eyeing mining operations not just for BTC yields, but as multifaceted financial instruments.

The next generation of miners won’t survive on hardware alone. They’ll need to navigate the intersection of finance, energy, and high-performance computing. The industry’s golden age of simple profitability is over—what comes next will demand innovation at every level.

UAE Proposes 2027 Crypto Tax Rules Targeting Bitcoin Firms

The United Arab Emirates is set to overhaul its cryptocurrency tax reporting framework by 2027, with a particular focus on Bitcoin firms and other digital asset businesses. The Ministry of Finance has signed the Multilateral Competent Authority Agreement under the Crypto-Asset Reporting Framework (CARF), aligning UAE standards with global tax transparency initiatives.

An eight-week industry consultation period is underway, closing November 8, to refine implementation details. The CARF mechanism will enable automatic exchange of tax-related information on crypto-asset activities between international authorities starting in 2028.

Cryptocurrency firms operating in the UAE will need to upgrade onboarding, record-keeping, and reporting systems to comply with the new regulations. The move signals the country's commitment to providing regulatory clarity while maintaining its position as a crypto-friendly jurisdiction.

Could Bitcoin Deliver 10x Returns?

Bitcoin (BTC -2.87%) continues to defy traditional valuation metrics, emerging as a disruptive force in the global store of value. From its inception as a digital curiosity to a $2.3 trillion asset class, BTC has rewarded long-term holders with a 967% return over five years. The question now is whether it can replicate this performance.

Gold's $24.8 trillion market valuation serves as the benchmark. Bitcoin's programmatic scarcity, portability, and divisibility present a compelling case for parity. A 10x appreciation WOULD require BTC to match gold's historic role—a plausible scenario given institutional adoption trends.

Sygnia Cautions South African Investors Against Overexposure to Bitcoin ETF

South African asset manager Sygnia Ltd. is tempering enthusiasm around its newly launched Bitcoin ETF, warning investors against allocating excessive portfolio weight to the volatile cryptocurrency. CEO Magda Wierzycka revealed the firm actively intervenes when clients attempt full portfolio switches into the Sygnia Bitcoin Plus fund, calling such moves "silly" during a Bloomberg TV interview.

The Johannesburg-based manager recommends capping crypto exposure at 5% of discretionary assets, citing Bitcoin's 82% annual gains alongside persistent volatility. The fund, which tracks BlackRock's iShares Bitcoin Trust, saw its reference asset dip 2.3% to $112,735.12 during Monday's trading session.

While Bitcoin's 40% current volatility marks an improvement from historical 200% swings, Sygnia emphasizes emerging market investors face amplified risks. The warning comes as South Africa's crypto adoption accelerates, with regulators still formulating comprehensive digital asset frameworks.

Bitcoin’s Final Buy Zone? Pre-Euphoria Signal Flashes Bullish

Bitcoin has entered a Pre-Euphoria phase, mirroring historical patterns that preceded its most explosive rallies. Analysts point to the 30-day MVRV spread between long-term and short-term holders as the key indicator—a metric that accurately signaled major breakouts in 2013, 2017, and 2021.

Despite recent bearish patterns on daily charts, the broader trajectory remains decidedly bullish. Current MVRV levels hover below historic overheating thresholds, suggesting the market is still in the early stages of its upward move. "We're not at overheated levels yet," notes CryptoQuant analyst Crazzyblockk.

The cryptocurrency has been range-bound between $114K support and $117K resistance before Monday's sudden dip. Such consolidation periods typically precede parabolic advances, with previous cycles showing months of accumulation before rapid price appreciation.

Bitcoin’s Sharp Decline Triggers $277 Million Long Liquidation Wave

Bitcoin's recent price slump has ignited a cascade of long liquidations, with $277 million in futures positions wiped out within 24 hours. The sell-off reflects eroding bullish momentum as BTC extends its decline by 3% amid tepid market activity.

Derivatives traders face mounting pressure as critical support levels buckle. Coinglass data reveals concentrated liquidations among Leveraged long positions, forced to unwind as prices breached risk thresholds. Santiment metrics show trading volume surging 90% to $45 billion—a telltale sign of capitulation.

Will Gold and Silver Beat Bitcoin in 2025? Peter Schiff Prediction

The competition for safe-haven assets intensifies as gold, silver, and Bitcoin vie for dominance in 2025. Peter Schiff, a vocal proponent of precious metals, predicts traditional assets will outperform Bitcoin. His stance underscores the ongoing debate between established stores of value and digital alternatives.

Market participants remain divided. Gold and silver benefit from centuries of trust, while Bitcoin's scarcity and technological edge attract a new generation of investors. The outcome hinges on macroeconomic conditions, regulatory developments, and institutional adoption patterns.

Bitcoin Suffers $1B Liquidation as Leverage Washout Resets Market

Bitcoin's weekend rally met a brutal reckoning as over $1 billion in leveraged positions were liquidated. The flushout, tracked by Coinglass, underscores how retail traders chasing momentum were caught offside. Open interest collapsed in tandem—a textbook leverage reset that purges weak hands and restores equilibrium.

Technical signals now paint a conflicted picture. Bitcoin faces immediate resistance after rejecting at the 61.8% Fibonacci retracement level, forming a lower high. Yet the absence of a confirmed lower low leaves room for ambiguity. The 50-day EMA band—historically reliable as dynamic support—now becomes the critical battleground.

Key price zones loom large. Holding above $110,720 could fuel a push toward the 50-EMA at $113,955, with $117,040 as the next upside target. A breakdown below current support risks retesting August's $107,250 low—a move that would confirm bearish trend reversal. The market now balances on two pivotal Fib levels: $112,624 (50% retracement) and $111,356 (61.8%), both intersecting with high-volume nodes from the August 14th peak.

Will BTC Price Hit 200000?

Based on current technical indicators and market sentiment analysis, BTCC financial analyst Mia provides the following assessment regarding Bitcoin's potential to reach $200,000:

| Factor | Current Status | Impact on $200K Target |

|---|---|---|

| Price Position vs MA | Below 20-day MA ($113,979) | Short-term resistance |

| MACD Momentum | Bearish (-683.32 histogram) | Needs reversal signal |

| Bollinger Band Position | Near middle band | Consolidation phase |

| Market Liquidation Events | $277M recent liquidations | Market reset opportunity |

| Adoption Developments | Positive growth signals | Long-term supportive |

Mia suggests that while current technical conditions show short-term bearish pressure, the fundamental adoption trends and market reset could create conditions for significant upward movement. However, reaching $200,000 would require sustained bullish momentum and breaking through multiple resistance levels identified in the technical analysis.